Content

Mistakes on your financial documents can lead to expensive nuisances like tax audits. If you miss a bill or neglect to pay something important, it could adversely affect your credit rating. A deeper understanding and accurate reconciliation of your expenses. It’s this same deliberate, collaborative approach that defines the entire client relationship at The Clem Collaborative. We develop tax strategies for you and your business that are designed to reduce the tax you pay. If anything needs to be fixed, adjusted or there is an error, we will take care of it, no extra charge.

Self-Employed Workers Are About To Be The Majority Of The Workforce. What Should They Know About Running Their Own “finance Department”? – Forbes

Self-Employed Workers Are About To Be The Majority Of The Workforce. What Should They Know About Running Their Own “finance Department”?.

Posted: Tue, 07 Mar 2023 15:00:00 GMT [source]

Looking to hire a bookkeeping service for your small business? Be sure they are experienced in your industry, have a reputation for accuracy, and offer a flat monthly fee. These trained professionals record income and spending, and are an important part of any business.

Just need to file your taxes?

Learn about taxes, bookkeeping tips, and how to grow your small business. We help small and growing businesses to perform even better with our customized and affordable solutions, helping them to make better business decisions. If our clients have good numbers and understand how to use them, they will not fail. Davis Professional welcomes the opportunity to show you how to save up to 40% by outsourcing your bookkeeping. Next, we’ll check out your accounts and start crunching the numbers. When we know where your business stands, we can begin organizing your finances.

Of course we strive to be error free every time all the time, but if once in a blue moon an error occurs, we take full responsibility and fix it immediately. If you are ever truly dissatisfied and we can’t make it better, then of course we will refund your last payment in full, no questions asked. All the improvements you made the the space and the equipment and fixtures you installed are part of the value of the business- it should be counted!

Ways Outsourced Bookkeeping Can Save Your Small Business Money

Your monthly work will be back in your hands by the 15th of the following month or sooner. If you are on the weekly plan, you will get your numbers each week by the 5th day after the prior week ends, or sooner. Access all Xero features for 30 days, then decide which plan best suits your business. Bank reconciliation is a way to do quality control on your books. If you already have an accountant, talk to them about who they currently work with. If you can find someone they’re familiar with, it can make the relationship between the three of you even stronger, especially if you all use the same software.

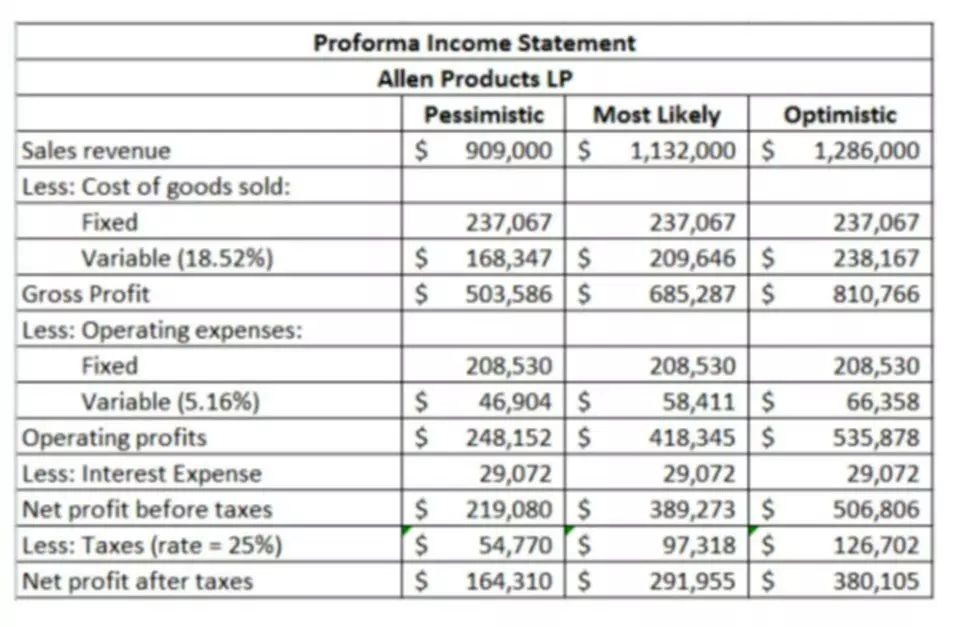

How do you price a bookkeeping business?

Price = Net Profit before tax x 100/ROI

Theoretically, it's the buyer's desired return on investment but in practice, business brokers tend to have a sliding scale based on the net profit of the practice using a high ROI percentage at low profit numbers, and lower percentages as the profit increases.

We will make sure the deposits are going in and the fees are recorded. If we see you are paying more in fees than is typical, we can help you either negotiate a lower rate or move to a different provider. Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

How to Pick Good Professional Bookkeeping Partners

Our bookkeeping consultant will sit with you and get to know your business. We understand that every business is different, which is why we tailor our bookkeeping services to fit your specific needs. Some of the bookkeeping services we offer include general ledger maintenance, accounts receivable/accounts payable management, bank reconciliations, and financial statement preparation. We also offer more specialized services, such as payroll and sales tax preparation. We take a holistic approach because we want each one of our clients to feel like our only client.

Your local business association may also give you some leads. Check if there is a bookkeepers association or something similar listed in your area. Do you want face-to-face interactions or will you be happy with remote service? The services can be delivered remotely but you might want someone to come in to your business regularly. If you’re committed to a certain type of software you’ll want to find a bookkeeper that also uses it. Bookkeepers increasingly use software to take care of recurring tasks.

Why You Shouldn’t Hire A Bookkeeper Full time

They will also caution you against taking out too much professional bookkeeping service during more profitable months. Your business could greatly benefit from the extensive experience of seasoned bookkeepers who have worked with numerous other companies to successfully address their financial problems. Based on their unbiased financial opinion, these outsourced bookkeepers can implement proven strategies into your financial operation that have been used and practiced in your industry.